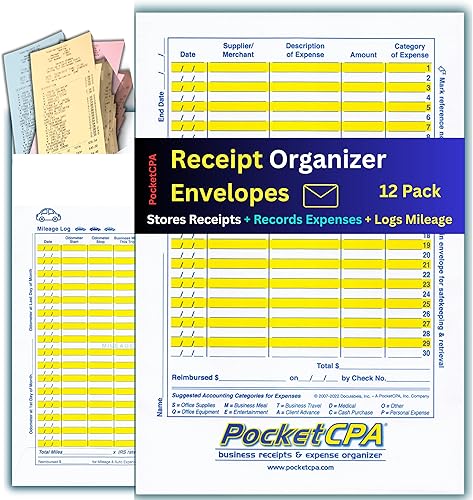

Adams ABFAFR12 libros de registro para automóviles, Blanco

Categoría: Formularios de Kilometraje y Gastos

Precio y disponibilidad de Adams ABFAFR12 libros de registro para automóviles, Blanco

$ 192.777

Tiempo de entrega estimada Sábado 14 de marzo al Viernes 20 de marzo.